Why Dental Insurance Still Matters

While many Americans have medical insurance, dental coverage is often left out—and the costs can add up quickly. Without a plan, even basic preventive care can exceed $300 per year, and major procedures can run into the thousands.

Choosing dental insurance for individuals and families ensures:

- Lower annual dental expenses

- Access to a broader network of providers

- Coverage for preventive, basic, and major treatments

- Greater predictability in dental care budgeting

Key Features of Leading Dental Insurance Plans in 2025

Modern dental insurance providers have expanded their offerings with flexible coverage tiers. Most plans now offer:

- Preventive care at 100% coverage: Cleanings, X-rays, exams

- Basic procedures at partial coverage: Fillings, extractions

- Major procedures with variable support: Bridges, dentures, root canals

- Orthodontic options: Included in family plans or at a premium

- No waiting periods for preventive services

These options help both individuals and families manage dental health without financial surprises.

Affordable Dental Plans Comparison for 2025

| Provider | Individual Plan (Monthly) | Family Plan (Monthly) | Preventive Care | Waiting Periods |

|---|---|---|---|---|

| Cigna Dental | $19.99 | $49.99 | ✅ 100% covered | None to 6 months |

| Guardian Direct | $18.00 | $42.00 | ✅ Yes | 6 months |

| Humana Dental | $20.50 | $51.00 | ✅ Yes | Varies by plan |

| Delta Dental | $21.00 | $55.00 | ✅ Yes | None for exams |

| Spirit Dental | $23.00 | $60.00 | ✅ Yes | No waiting period |

These affordable dental insurance plans offer strong coverage for preventive and basic needs with family-friendly pricing.

Tailored Coverage for Individuals vs. Families

Individuals

- Focus on preventive care and basic procedures

- Lower monthly premiums

- Optional orthodontic or cosmetic add-ons

Families

- Combine multiple members under one policy

- Pediatric coverage including fluoride and sealants

- Coverage for braces or aligners for teens

- Shared deductibles or annual limits

With options designed for every life stage, it’s easier than ever to build a custom dental coverage plan.

Dental Insurance vs. Dental Discount Plans

For those not needing full coverage, dental discount plans can be an alternative:

- Offer savings at participating dentists

- No annual limits or claims process

- Immediate activation

- Lower monthly cost than insurance

However, these plans typically don’t cover major procedures and may offer less protection over time.

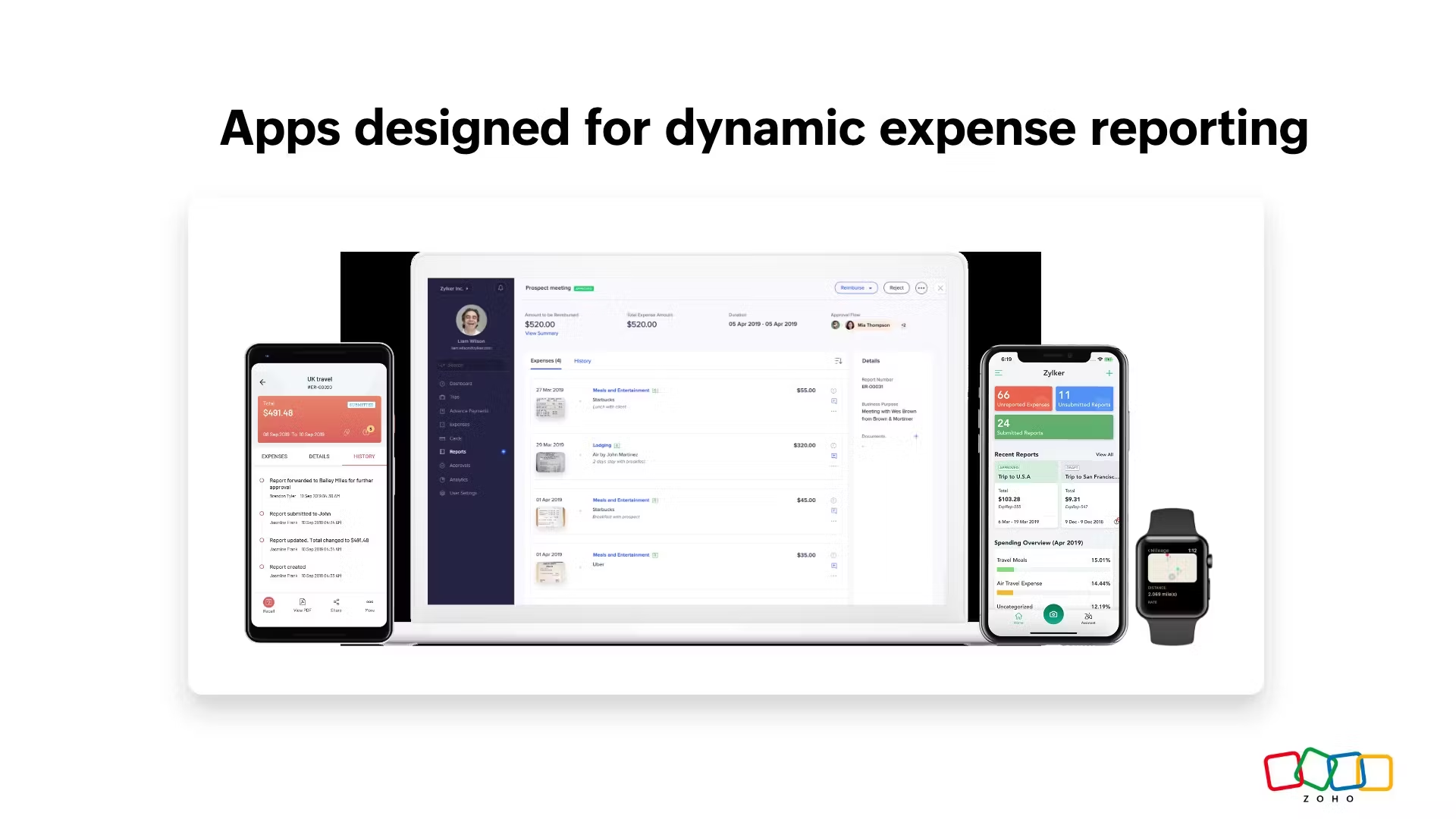

Trends Making Dental Insurance Smarter in 2025

The dental insurance industry is evolving rapidly. Here are trends shaping plan features:

- Bundled dental and vision plans

- Digital plan management apps

- AI-powered claims processing

- Increased transparency with upfront cost estimates

- In-network loyalty perks (e.g., rollover unused benefits)

These innovations are simplifying plan management and improving customer satisfaction.

Conclusion: Choose the Right Dental Insurance for Long-Term Wellness

With rising healthcare costs, protecting your teeth with a reliable dental insurance plan is more important than ever. Whether you're an individual looking for basic preventive care or a parent seeking full family protection, there are flexible, affordable options to meet your needs in 2025.

Explore your coverage choices today and take the next step toward healthier smiles—for everyone in your household.