In 2025, passive investing has matured, offering more tools and asset classes than ever before to help individuals achieve financial independence.

What Is Passive Investing?

At its core, passive investing means putting your money into assets that don’t require regular buying and selling. It’s the opposite of active management, which involves constant research, stock picking, and market timing.

Key features of passive investing include:

- Low-cost index funds and ETFs

- Automated portfolio rebalancing

- Minimal trading activity

- Focus on long-term returns over short-term gains

It’s a strategy popularized by investors like John Bogle (founder of Vanguard) and endorsed by Warren Buffett.

Popular Passive Investment Vehicles in 2025

| Investment Type | Description | Risk Level | Typical Return (10-Yr Avg) |

|---|---|---|---|

| Index Funds | Tracks broad markets like S&P 500 | Moderate | 7%–10% |

| Dividend ETFs | Holds dividend-paying stocks | Low-Med | 5%–8% (with yield) |

| REIT ETFs | Invests in real estate through the market | Moderate | 6%–9% |

| Target-Date Funds | Adjusts risk over time based on retirement | Low-Med | 5%–8% |

| Robo-Advisors | Automated portfolios based on goals | Custom | 4%–9% depending on settings |

These vehicles require minimal management and can be automated with monthly deposits or workplace retirement plans.

Why Passive Investing Works in 2025

With market volatility, AI-driven trading, and rising interest in global markets, many investors find comfort in passive strategies that:

- Eliminate emotional decision-making

- Avoid excessive management fees

- Maintain consistent exposure to the market’s growth

- Beat most actively managed funds over time

Studies consistently show that 90% of active fund managers underperform their benchmarks over the long run.

Technology Makes Passive Investing Easier Than Ever

In 2025, fintech platforms are making it seamless to grow wealth passively:

- Robo-advisors like Betterment, Wealthfront, and Fidelity Go adjust portfolios automatically

- Fractional shares allow investing with just $10

- Recurring deposits and auto-rebalancing keep portfolios on track

- Tax-loss harvesting tools minimize capital gains taxes

For investors who value simplicity, automation is the ultimate partner in wealth-building.

Common Myths About Passive Investing

Despite its benefits, passive investing still faces a few misconceptions:

- ❌ "It's only for beginners." In truth, institutions like pensions and endowments rely heavily on passive strategies.

- ❌ "You won’t get big returns." While you may not beat the market, you can match it—and that’s often better than most.

- ❌ "You need a lot of money to start." With no-minimum ETFs and zero-fee brokers, you can start with $1.

The key is consistency and time—not capital or complexity.

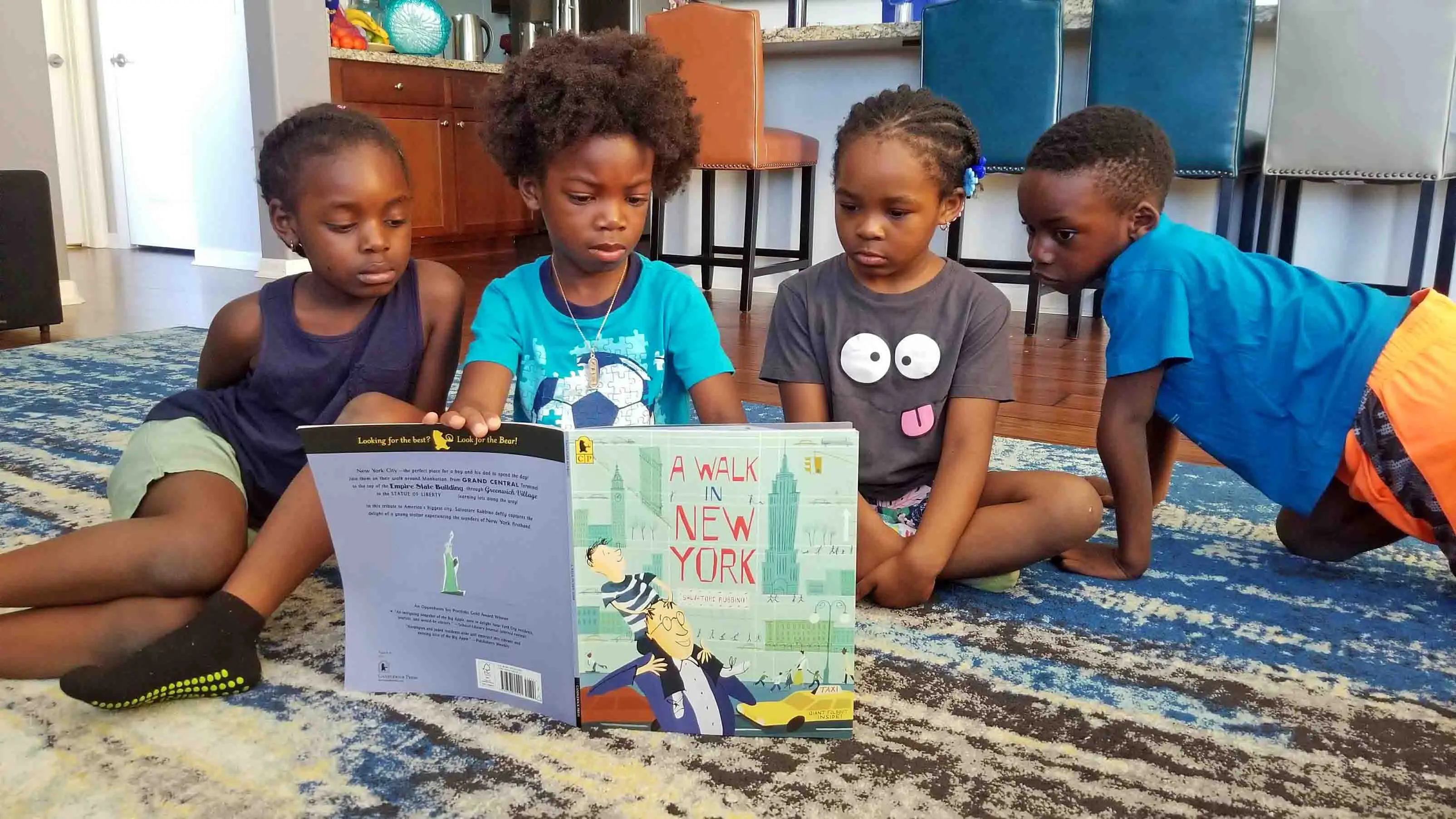

Conclusion: Build Wealth Without the Hustle

In a market where noise and hype dominate the headlines, passive investment strategies remain refreshingly effective. Whether you’re saving for retirement, building a child’s education fund, or planning financial freedom, the best approach may simply be the most boring one—automated, diversified, and patient.

Let your money work for you—quietly, powerfully, and passively.